1Q2014 Market Review and 2014 Outlook from Here

As spring returns and the market heats up, here are some observations about the terrain for residential real estate transactions for this coming year, and some highlights of the frigid quarter just finished.

Inventory increased in the first quarter of 2014 by the largest percentage in years, however, supply remains at historic lows overall. New construction continues to lag behind pre-recession levels, and many new developments have been geared towards either the rental market where 2,700 new units will be entering the market in Hell’s Kitchen, or the luxury market, where record setting deals have garnered headlines.

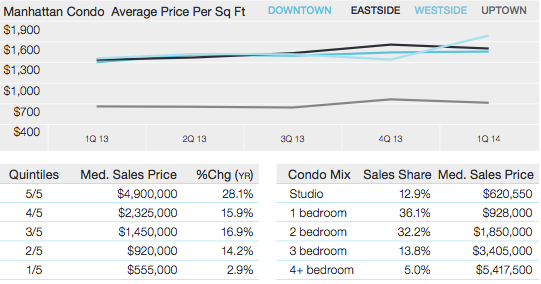

Despite low inventory, transactions substantially increased last year and in the first quarter, leading to a contracted sales environment where apartments spent very little time on the market. This put the seller in a powerful negotiating position, driving the median sales price up by 14% to $1.355MM, and average price per square foot up 15.5% to a new record level of $1,591. t is clear from these numbers that Sellers capitalized on their position of strength by holding out for their asking price or more through the dreaded closed bid process known as the best and final – which despite its name more often than not for a hot listing sets the bogey for even higher offers that turn-up should one not push their attorneys to get that contract signed within a few days (or even better, within 24 hours. Sellers also eliminated risk wherever possible; preferring cash offers to finance contingencies, with mortgaged deals comprising less than half of the transaction for the quarter (despite the free money available through mortgages today).

The inventory issue does not seem likely to be relieved much in 2014 for buyers in the $1-2 million range, the epicenter of the shortage. Some buyer’s may shy away if the speculation about the Fed raising interest rates comes to pass, but for now, the environment continues to be primed for heavy demand with short supply.

Value Opportunities in Fixer Uppers and Uptown Manhattan

Despite seller’s position in the market there is value to be found if you look in the right places. In a city rife with pre-war buildings asset improvement opportunities abound for those with the time, passion, and creative drive to take over a space and make it their own. If done efficiently the upsides can be enormous, and rewarding. You not only get a personalized living space, but great resale value.

The renaissance of Upper Manhattan, which saw the substantial increases in sale prices of 2013 continue through the first quarter, still provides buyers with great value opportunities. Stick to the west side of Central Harlem and Hamilton Heights where a fantastic stock of existing pre-war apartment buildings are being updated and repurposed into well-appointed condominiums; gracious brownstones and Limestone townhouses are being reclaimed as single family homes; and new builds are bringing amenity rich luxury options to these diverse neighborhoods. With efficient subway links to midtown, even on weekends, a vibrant food scene drawing on the diverse legacy of the neighborhood, and the new $6.8 billion, 17-acre Manhattanville Campus at Broadway and 125th Street, in the next few year all the infrastructure will be in place to support a truly great NYC neighborhood. A neighborhood that is ready to battle with the best that downtown has to offer, for the opportunity to be the place you are happy, and proud, to call your home.

Be Prepared

The dynamics of the current market place a premium on preparation for buyers, with that Boy Scout motto of “Be Prepared” ringing as true in NYC real estate as it does in so many other aspects of life. Working with an agent, the first step in the search should be for she/he to help arrange for the attorney who is essential in shepherding your deal to close, and to organize the financial documents like bank/brokerage statements and tax returns that are summarized in the REBNY Financial Statement that accompanies the critical mortgage preapproval (preferably from the efficient, and effective team at Citibank) that are submitted with your offer to prove you have a financial resources to close the sale. Delays due to lack of organization will cut you out of a great opportunity in this market.

Please peruse the comprehensive TOWN Buyers Guide for more on the Buying Process.

Resources:

Miller Samuel Manhattan 1Q14 Report for Douglas Elliman

http://www.millersamuel.com/files/2014/04/Manhattan_1Q_2014.pdf